Tourism has dropped sharply in Nepal due to the earthquake, landslides, and avalanches, resulting in cancellation of bookings and changed travel plans.

Tourism has dropped sharply in Nepal due to the earthquake, landslides, and avalanches, resulting in cancellation of bookings and changed travel plans.

In a blog post on 1 May, we presented a quick preliminary analysis of the economic impact of the 7.8 magnitude earthquake that struck Nepal on 25 April.

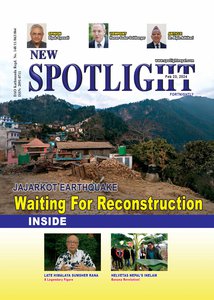

A subsequent 7.3 magnitude aftershock on 12 May brought further casualties and inflicted added damage to property. The government has declared 14 districts as severely affected (mostly in the central and western regions) although the earthquake and its aftershocks have affected about two-thirds of Nepal’s 75 districts.

This piece updates the analysis by incorporating data and information from the last three weeks.

Outlook.

The agriculture, industry, and services sectors will see a varying degree of slowdown as a result of the earthquake and powerful aftershocks, which will likely drag GDP growth down to 3.8% in the fiscal year (FY) 2015 ending 15 July 2015, 0.8 percentage points lower than the 4.6% rate forecast in ADB’s Asian Development Outlook 2015 published in March. There is a prospect for even lower growth (between 3% and 3.5%) if supply disruptions become more intense than we currently expect. GDP grew by 5.2% (at basic prices) in FY2014. In FY2016, the loss of seeds, farmland, and livestock, and a weak forecast monsoon will mean agricultural output will remain weak but the industry and services sectors are expected to rebound – depending on the speed of rehabilitation and reconstruction activities, and their impact on aggregate demand. This could result in GDP growth of about 4.5% next year. Within the services sector, the real estate and renting sub-sector is expected to further slow but a modest pick-up in hotel and restaurant activities is likely due to a partial recovery of tourism sector. The possibility of higher growth rate (between 4.5% and 5.5%) exists, but it will be contingent upon the scale and pace of rehabilitation and reconstruction efforts.

Agriculture

Beyond the impact of last year’s delayed and light monsoon, the impact of the earthquake on agricultural production (which accounts for about 34% of GDP) will be minimal this fiscal year given that harvesting is already largely completed.

However, there has been substantial loss of food stocks and livestock, and aftershocks have swept away farmland in some of the severely affected districts. The 14 most affected districts account for 13.8% of the total area of agricultural holdings. The share of paddy (rice) produced in these districts is about 9.1% of national production while the area under paddy production accounts for 8.6% of the country’s total paddy area. Production of maize and millet will be somewhat more affected given that these 14 districts together account for a relatively large 23.4% and 28.7% of national production, respectively.

Given these effects, we are less upbeat on the outlook for the agricultural sector than we were on 1 May, and now see agricultural output growth this year at 2.5% versus the 3.0% growth we predicted in May and in March. The loss of farmland and livestock in the severely affected areas, and the recent forecast of a potentially weak monsoon (influenced by the building up of El Niño conditions over the Pacific) will likely keep agricultural sector growth stagnant in FY2016.

Industry

Growth in the industrial sector (which accounts for about 15% of GDP) has been held back by lack of adequate electricity and other supply-side bottlenecks for a long time. The earthquake will further slow industrial activities in the remaining months of FY2015.

The severely affected districts account for about 20% of total manufacturing establishments, manufacturing jobs, and manufacturing value-added in the country. Similarly, nearly a quarter of the total hydropower produced in the country is affected by the earthquake. The drastic slowdown in capital spending and building activities following the earthquakes will hit construction.

The cumulative impact of these sub-sectoral developments means that we now see industrial growth at 2.3%, lower than the 3.5% level forecast in March. In FY2016, the planned reconstruction spending, and prospects of hydropower plants resuming normal operation, will likely boost industrial sector growth.

Services

The services sector (which accounts for about 51% of Nepal’s GDP) will be the most affected by the earthquake. There has been a drastic slowdown in wholesale and retail trade in the severely affected districts as warehouses, shops, and trading outlets are only partially operational. Tourism has dropped sharply due to the earthquake, landslides, and avalanches, resulting in cancellation of bookings and changed travel plans. Furthermore, the partial opening of banks and financial institutions in the affected districts will slow credit flows and other transactions.

The combined effect of these circumstances will lower services sector growth from the 5.8% forecast in March to around 5.1%.

In FY2016, the rebound of wholesale and retail trade, tourism (to some extent), and the normalization of financial activities will likely mean services sector growth will shoot up, despite a potential lull in the real estate and renting services sub-sector.

This is the second of a series of 3 post-disaster blog posts about the economic impact of Nepal’s earthquake by ADB’s chief economics officer in the country.

Sapkota: Economics Officer, Nepal Resident MissionA former consultant for the Government of Nepal, GIZ, UNDP and FAO, Sapkota previously worked as a researcher at South Asia Watch on Trade, Economics and Environment in Kathmandu and was a junior fellow at the Carnegie Endowment for International Peace in Washington, DC. He has authored numerous papers and reports on macroeconomic issues in Nepal and other developing countries.

- Five months after the earthquake, where does Nepal stand?

- Oct 01, 2015

- Final take on economic and poverty impact of Nepal earthquake

- Jul 03, 2015

- Updated Economic Outlook

- Jun 13, 2015

- Updated economic outlook following Nepal’s earthquake – prices, trade, budget

- May 22, 2015

- Updated Economic Outlook Following Nepal’s Earthquake — Needs And Priorities

- May 21, 2015