More on Economy

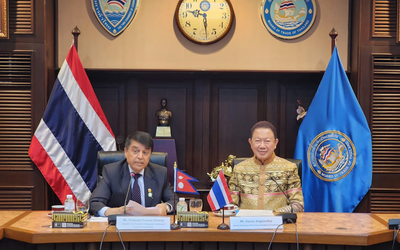

Thai Business Community Responded Positively To Invest In Nepal

By NEW SPOTLIGHT ONLINE

3 days, 10 hours ago

Global IME Bank Cardholders Get Up to 10% Cashback at Salesberry

By NEW SPOTLIGHT ONLINE

3 days, 10 hours ago