With prolonged political protests in the Terai-Madhesh and supply disruption along Nepal-India border for almost four months now, the prices of goods and services have gone higher. Short supply of petroleum products has thrown the supply situation badly out of gears sending the prices of essential commodities surging in the recent months.

As the new government led by prime minister K.P. Sharma Oli is celebrating its 100 days, prices of consumer goods have surged by an average of 11.6 per cent in December. According to Nepal Rastra Bank, this is the highest in the last 40 months. The last time prices had jumped to this level was in August 2012, when inflation stood at 11.9 per cent. After that the prices had started coming down as Nepal was able to manage inflation. The inflation figures between January 2014 and October 2015 were limited to a single digit.

The protests in the Tarai and blockade on Nepal-India border points prompted prices to jump by 10.4 per cent in November.

According to Nepal Rastra Bank’s Macroeconomic Report published in December, the prices of food and beverage items surged by an average of 14.8 per cent, while prices of non-food items and services jumped by 9.1 per cent.

“Food and beverage prices went up by over 10 per cent, as items like pulses and legumes became expensive by a startling 48.9 per cent, while ghee and cooking oil became costlier by a whopping 42.3 per cent. Some of the non-food items also saw double-digit hike in prices in December,” the report said.

Similarly, the prices of clothes and footwear, for instance, surged by 14.6 per cent; education fees jumped by 12.5 per cent; and housing and utilities cost went up by 11.4 per cent. According to the report, the reason behind the high price is the constraints in the supply side.

Along with transport disruption, lack of raw materials led to higher imports of finished goods. Similarly, inadequate supply of electricity and key inputs to ramp up production, and protests were responsible to reduce the supply.

A land-locked country, Nepal heavily relies on imports for almost all of the goods from abroad, mostly India. As terai protests and border blockade affected the supply-side, the flow of petroleum and food products, raw materials and other essentials coming into Nepal got disrupted.

The report pointed out that the impact of supply disruption was greatly felt in the Kathmandu Valley where consumer prices surged by 13.2 per cent in December. Despite the protests, the Tarai saw prices rising at a relatively slower pace of 10.2 per cent.

As the supply situation is gradually coming to normalcy, there is a positive indication that things will return to normal in the next months. According to the report, a spiral of price hike was witnessed since mid -September.

Along with supply-side constraints, inflationary pressure being built in India is also pushing up prices in Nepal. Inflation in India stood at 15-month high at 5.6 per cent in December. Since over 60 per cent of the goods consumed by the country are imported from India, the impact of price hike in the markets of the southern neighbor is automatically passed on to Nepal.

Despite all this, the widening inflation wedge between Nepal and India is noticeable. In December 2014, for instance, inflation in Nepal stood at 7 per cent compared with 4.9 per cent in India, reflecting inflation wedge of 2.1 per cent. This December, inflation wedge widened to six per cent.

The NRB report says the widening inflation wedge was on account of lingering impact of earthquakes of April and May, unrest in southern plains and the recent disturbances on trade routes in southern parts of the country.

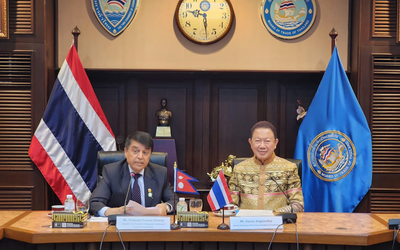

Talking to media persons at Tribhuwan International Airport, finance minister Bishnu Paudel said that the inflation will come down as the supply situation is gradually improving. “ We are expecting that the situation will be normal soon,” said Finance Minister Paudel, who returned from taking part in AIIB inaugural Ceremony in China.

Despite prediction of the inflation coming down, the Nepalese economy is likely to see a high inflation until the supply of goods and services resume fully.

- IME GROUP: Expands Into Paper Industry

- Mar 24, 2025

- CPN UML: Instigated By India

- Mar 23, 2025

- ADB’S CHIEF ECONOMIST: Nepal Reduces Poverty

- Mar 11, 2025

- FM DR. DEUBA: A Successful Visit

- Mar 11, 2025

- MD GHISING: Target Of Personal Grudge

- Mar 09, 2025