At a tune when the lockdown imposed by the government to contain the coronavirus has badly affected the small and medium enterprises, IFC’s new package will give life to them.

Private equity funds like Dolma can be an important source of capital and expertise for Nepali firms that have potential to grow, including those struggling to deal with the impacts of the COVID-19 pandemic, according to IFC Resident Representative in Nepal, Babacar S. Faye.

His comments follow IFC’s decision to invest$10 million in Dolma Impact Fund II (DIF II) to help provide financing to small and medium sized enterprises, (SMEs)in healthcare, renewable energy, technology, and other critical sectors, vital to the recovery of the pandemic-battered economy.DIF II is managed by Dolma Fund Management.

SMEs are a key engine of growth in Nepal, contributing 20 percent of gross domestic product (GDP) and creating over 60 percent of jobs in the country. Even before the pandemic hit, SMEs were already struggling with limited access to finance. At present only 39 percent of Nepal’s SMEs have access to finance.Availability of additional financing for SMEs will be key to any sustainable and inclusive economic recovery in Nepal

“Dolma Fund Management is one of the first private equity fund managers focused on Nepal. It completed the initial $40 million close of Dolma Impact Fund II in May 2021, to invest in companies with strong growth potential, especially small and medium businesses," said Tim Gocher, CEO of the Dolma Fund Management. "This will help scale up their capacity, increase skills and competitiveness, and create sustainable employment in Nepal. The target fund size is $75 million. We are confident that IFC’s participation will further catalyze fund raising and help us reach our target size.”

IFC's equity investment includes $5 million from the International Development Association’s Private Sector Window, created to catalyze private sector investment in low-income countries.The overall investment is part of IFC’s SME Ventures program, which provides risk capital to entrepreneurs and fund managers in low-income countries where such funding is scarce or unavailable.

“With the rise in COVID-19 cases, Nepal is in a difficult spot, but we believe in the country's potential,” said IFC Resident Representative in Nepal, Babacar S. Faye. “By providing capital in emerging markets like Nepal, where it is scarce, private equity funds can help local businesses expand their operations, create more jobs, and provide critical goods and services. We also hope that this will send a strong signal to the market that we are confident in the resilience of Nepal’s entrepreneurs.”

With a combined capital of less than $100 million, private equity funds operating in Nepal are smaller than those in other emerging economies andthere issignificantpotential for growth. IFC’s latest investment in DIF II marks its second in private equity in Nepal.

In 2015 IFC invested $7 million in Business Oxygen (BO2), Nepal's first domestic private equity firm, which was subsequently increased by another $7.3 million in 2017. The additional investment was made through two funds managed by IFC, financed by the Climate Investment Fund’s Pilot Program for Climate Resilience (PPCR) and United Kingdom’s Foreign and Commonwealth Office (FCDO). BO2, has invested in about 10 high-growth SMEs, helping them achieve their potential and create hundreds of jobs.

IFC’s current combined committed portfolio in Nepal stands at $550 million.

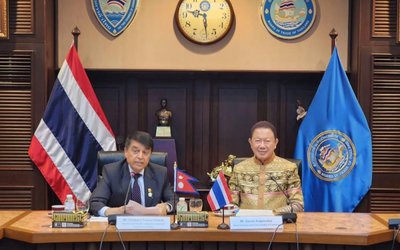

- NEPAL-THAILAND: Joint Business Council

- Apr 13, 2025

- BIMSTEC SUMMIT: Nepal’s Stand

- Apr 11, 2025

- IME GROUP: Expands Into Paper Industry

- Mar 24, 2025

- CPN UML: Instigated By India

- Mar 23, 2025

- ADB’S CHIEF ECONOMIST: Nepal Reduces Poverty

- Mar 11, 2025