As the new government is yet to come out with its new budget amending the old one, Nepal Rastra Bank has faced the most difficult time. Governor Maha Prasad Adhikari unveiled the Monetary Policy for the fiscal year 2021/22 projecting that the inflation would be contained at 6.50 per cent.

Unveiling the monetary policy, Governor Adhikari announced the monetary policy is focused on increasing the broad money by 18 per cent on the basis of the nominal GDP growth target. He also said that the policy will support the economic growth target,

He also announced plans to maintain record of digital transactions and settle digital transactions that take place within the country by interlinking digital payment tools. The central bank has also announced plans to establish a national payment gateway to introduce payment cards.

The cash reserve ratio is to be maintained the same as in the past fiscal year, at 3 per cent. He also announced a number of incentives for banks and financial institutions going for merger. It has also set a ceiling of Rs 120 million from banks against the deposit of shares.

The governor has announced to promote fiscal year 2021/22 as electronic transaction promotion year. Adhikari said that the policy focus is on developing necessary infrastructures and promoting awareness among people for the electronic payment.

Among others, the bank also set a plan to increase the record of digital transactions and settle digital transactions that take place within the country by interlinking digital payment tools. The new policy also plans to establish a national payment gateway to introduce payment cards.

Along with others, the policy has also provided a number of incentives for banks and financial institutions going for merger. It has also set a ceiling of Rs 120 million from banks against the deposit of shares.

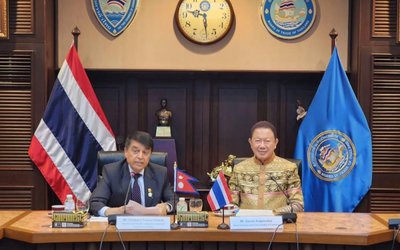

- NEPAL-THAILAND: Joint Business Council

- Apr 13, 2025

- BIMSTEC SUMMIT: Nepal’s Stand

- Apr 11, 2025

- IME GROUP: Expands Into Paper Industry

- Mar 24, 2025

- CPN UML: Instigated By India

- Mar 23, 2025

- ADB’S CHIEF ECONOMIST: Nepal Reduces Poverty

- Mar 11, 2025