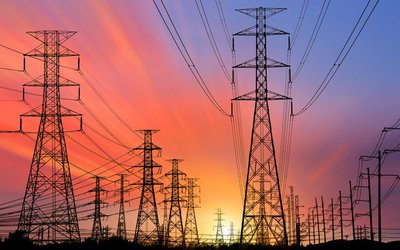

The Upper Tamakoshi Hydropower Limited's promoter shareholders have paid for their rightful shares. Starting September 4, the company is issuing right shares to shareholders for the 456 MW Upper Tamakoshi Hydropower Project at 1x1 shares.

The Nepal Electricity Authority, Nepal Telecommunications Company Ltd. Citizen Investment Trust and National Insurance Corporation were the founders of the company before issuing shares to the general public.

They have paid for their shares of the right shares proportional to their ownership. The founders invested 5.4 billion rupees. The company's total paid-up capital is now 21.18 billion rupees.

The NEA owns 41 percent of the company, Nepal Telecom has 6 percent, and Citizen Investment Fund and National Insurance Corporation each hold 2 percent of founder shares. Based on share ownership, NEA paid 4.34 billion, Nepal Telecom paid 635.4 million, and Citizen Investment Trust and National Insurance Corporation paid 211.8 million rupees for their rights shares. The shares were then distributed after payment.

Out of the company's common shares amounting to 49 percent, Depositors employees of Employees Provident Fund owns 17.28 percent, employees of project’s lender companies own 2.88 percent, company and NEA’s employees own 8.84 percent, Dolkha residence owns 10 percent, and the general public owns 15 percent.

The general public must pay a total of 5.19 billion rupees, including 1.82 billion from Employees' Provident Fund depositors, 1.58 billion from the general public, 1.5 billion from Dolkha district residents, Rs.400.6 million from NEA employees and companies involved, and 300.49 million from employees of project loan providers. After this, the companies paid capital will be 21.18 billion.

During construction of the Upper Tamakoshi project, the company obtained a short-term loan of 6 billion rupees. After collecting the money for their rightful shares, the company will increase their paid-up capital to 21.18 billion rupees.

Mohan Prasad Gautam, the Chief Executive Officer (CEO), explained that the money raised from selling rights shares would be used to pay the short-term loan interest accrued during the Upper Tamakosi construction and to build the 21 megawatt Rolwaling Khola hydropower project.

CEO Gautam further stated that Rolwalling would manage their finances using the funds left over after paying off the interest on their early loan and the revenue gained from selling electricity from Upper Tamakoshi.

In addition, the company recently held its fifteenth annual general meeting in Kathmandu this past Wednesday. During the meeting, the Annual General Meeting (AGM) approved the company's annual report, balance sheet, profit and loss account, cash flow statement, for the financial year 2078/79.

- Nepal Makeathon Drives Innovation In Affordable Assistive Technology Solutions

- Feb 22, 2025

- First Meeting of SAARC IGEG on Poverty Alleviation and SDGs Held in Colombo

- Feb 22, 2025

- ADB Capital Utilization Plan Expands Operations by 50% Over Next Decade

- Feb 22, 2025

- Canada Fund for Local Initiatives (CFLI) 2024-25: Driving Positive Change in Nepal

- Feb 22, 2025

- Halesi Tuwachung Municipality Develops Its First Municipal Energy Plan

- Feb 22, 2025