Following a severe economic downturn brought on by COVID-19 and the Russian invasion of Ukraine, Nepal's economy is now headed in the right path for the upcoming fiscal year.

Asian Development Outlook 2023 September Forecasted increase in 2024 is 4.8% Due to slower development in South Asia and Southeast Asia, this update lowers the region's projected growth for this year to 4.7%. The 2024 growth prediction of 4.8 percent does not alter.

It is anticipated that from 4.4% last year to 3.6% in 2023 and 3.5% in 2024, inflation in developing Asia will decline. The People's Republic of China (PRC), where the inflation forecast is reduced down to 0.7%, will be largely responsible for this year's drop.

Downside risks to the outlook have increased. Weaknesses in the PRC's property sector will need to be closely monitored. Across the region, the authorities will need to take policy measures to ensure that supply disruptions and the broader impact of El Niño do not pose food security challenges. Financial stability risks require continued vigilance in vulnerable economies as the era of easy money comes to an end. On the positive side, a faster-than-expected decline in inflation in the United States could improve the global outlook.

Although Nepal still maintains several restrictions on the import of foreign goods and banking system, the gradual shift of Nepal's policies is creating a conducive environment for growth.

Nepal's economy is expected to grow by 4.3 percent (at market prices) in fiscal year (FY) 2024, up from an estimated growth of 1.9 percent in FY2023, according to the Asian Development Outlook (ADO) September 2023, the latest edition of the Asian Development Bank's (ADB) flagship publication.

With moderating inflation and comfortable foreign exchange reserves, Nepal Rastra Bank (the central bank) adjusted its monetary policy stance by reducing the policy rate by 50 basis points to 6.5%, which is expected to help reduce commercial interest rates and stimulate economic activities.

Services are expected to perform well with expansions coming from real estate, wholesale and retail trade and accommodation and food services. Agriculture growth may however decelerate owing to deficient rainfall in June and erratic weather patterns, further aggravated by lumpy skin outbreak in cattle.

The report projects annual average inflation to fall to 6.2% in FY2024 from 7.7% in FY2023 on subdued oil price increases and a decline in inflation in India, Nepal’s main source of import.

“Despite some progress in restoring price and external sector stability, fiscal challenges persist. While the estimated fiscal deficit for FY2024 is moderate at 2.4% of GDP, much lower than the deficit of 6.1% in FY2023, the actual deficit could be substantially higher if the government does not meet its ambitious revenue target for FY2024,” said ADB Principal Economist for Nepal Jan Hansen.

External risks remain relatively well contained. Considering the recent trends and the central bank’s prudent monetary policy stance, the target of maintaining foreign exchange reserves sufficient to sustain at least 7 months of imports seems achievable. Amid stable remittances and higher imports, the current account deficit is expected to widen to 1.8% of GDP as growth revives in FY2024.

Manbar Singh Khadka, Economist at ADB Resident Mission Nepal, presented the findings of Nepal Macroeconomic Update Setember 2023 issues. He said that Nepal’s economic growth for 2024 will better than what Nepal’s achieved1.9 percent in 2023.

Downside risks to the economic outlook in FY2024 may arise from more contractionary economic policy by the authorities to stem price rises given the uncertainties centered around geopolitical tensions. This may dampen consumption and domestic production and adversely affect growth.

- IME GROUP: Expands Into Paper Industry

- Mar 24, 2025

- CPN UML: Instigated By India

- Mar 23, 2025

- ADB’S CHIEF ECONOMIST: Nepal Reduces Poverty

- Mar 11, 2025

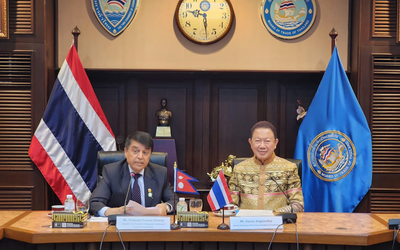

- FM DR. DEUBA: A Successful Visit

- Mar 11, 2025

- MD GHISING: Target Of Personal Grudge

- Mar 09, 2025