The phrase 'Think globally, act locally' has been repeated millions of times worldwide in recent years. The idea is to focus on your local environment and let your small actions add up, leading to change in your office, neighborhood, community, city, state, and beyond.

René Dubos, a French-American microbiologist, experimental pathologist, environmentalist, and humanist, proposed this idea. It has traditionally been associated with the environment and sustainability, but it can also be applied to innovation, banking, and other areas. In today's changing markets, only a few people are able to apply it.

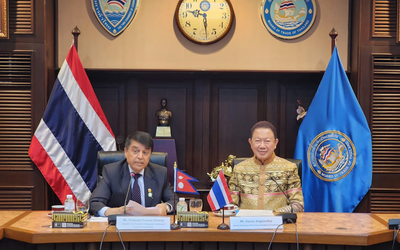

Chandra Prasad Dhakal, Chairman of Global IME Bank, was inspired by this phrase and has practically proven its effectiveness in Nepal's banking sector.

Dhakal entered the banking sector over two decades ago through IME Financial Institution. As the President of the Federation of Nepalese Chamber of Commerce and Industry, he proves that a global brand can make a difference by acting locally.

"Initially, we started as IME Financial Institution. Even that financial institution did not seem to help much in doing the remittance work." Dhakal said that since only commercial banks handle foreign exchange, he felt the need for a commercial bank in the area.

He decided to open a bank after securing financing. Initially, the central bank did not grant a banking license in Kathmandu, so they applied for a commercial bank license in Birganj. However, while the process was ongoing, the central bank opened provisions for granting licenses in Kathmandu as well.

Dhakal stated that they upgraded the bank, which was initially registered regionally, and centralized it, resulting in the opening of Global Bank. At that time, there was no IME. Following the establishment of Global Bank, there was no need for a commercial bank and finance from the same promoter.

Currently, Global IME Bank is a comprehensive financial institution consisting of 21 banks and financial institutions, including 5 commercial banks, 10 development banks, and 6 finance companies. Reconciling the interests of 21 presidents, 21 CEOs, and 7 boards of 21 organizations and management is not an easy task.

Global IME Bank, the largest commercial bank in Nepal, is a global brand that works to serve locally.

With representative offices in the UK, Delhi, and Australia, we have also opened a branch office in Korea after obtaining permission from the National Bank. It is important to note that Nepal's problem is not the lack of a credit rating. The country rating process has progressed as expected. Additionally, there is a plan to expand internationally.

Our bank currently has 4.5 million depositors, which is a significant achievement considering we started with no business, seed capital, and had to take care of our families.

Dhakal believes that we can do even more. Creating an organization that provides many types of jobs and pays taxes to the state is possible even without a foundation, as long as there is an environment. Dhakal stated that Global IME, despite being the 19th ranked bank, has paid the highest income tax. This is a matter of pride for us.

I aim to make Global IME Bank one of the thousands of banks in the world. This is not a significant challenge. Being one of the thousands of banks globally will help us become more global. Despite starting much later in Nepal, we became number one in a short period. If we continue to work hard, we can become one of the best thousand banks globally.

We have served a diverse clientele, from individual savers to large corporations. As digitalization continues to shape the industry, we are prioritizing our efforts to adapt. Our network currently spans all districts, and we

are undergoing some consolidation through mergers and acquisitions. It is imperative that every employee and branch strive to improve our services. We are currently working on it.

The central bank has clearly specified that the spread rate should not exceed a certain limit. It is now up to the banks and financial institutions to increase public confidence in the banking system. In some cases, slogans promoting the non-payment of bank loans have become popular, but these are only temporary. A bank loan is money borrowed from a bank that must be repaid with interest.

It is important to repay the loan on time to avoid financial difficulties. Banks should prioritize raising public awareness to increase public confidence in their services.

Dhakal stated, 'If we look at the time of private sector banks and even the last 20 years,'. There has been a radical change in Nepal's banking sector in the last 20 years, particularly in terms of service and accessibility. Digital banking has improved the quality and accessibility of services, and banks have expanded their reach to all local levels.

Before entering the business, I was a junior employee of Ratiri Commercial Bank. I took a job in a bank to help myself study, teach my siblings, and meet my basic needs. A bank job is considered a good and permanent job. My principle is to work diligently and honestly.

Global IME Bank Limited is the largest bank in Nepal's banking sector. Recently, it achieved a remarkable milestone by emerging as the highest taxpayer among all banks and financial institutions for the fiscal year 2078-79. This feat highlights the bank's robust financial standing and its significant contribution to the nation's economic development.

Global IME Bank contributed a corporate tax of Rs. 3,200 million for the fiscal year 2078-79. This demonstrates the bank's commitment to fulfilling its fiscal responsibilities and highlights its important role in supporting the national exchequer.

Global IME Bank's substantial tax contribution not only showcases its financial strength but also underscores its dedication to supporting the government's initiatives and the broader economic well-being of Nepal. The bank sets a standard for financial institutions by being the highest taxpayer in the banking sector, demonstrating the positive impact the private sector can have on the nation's revenue generation.

Global IME Bank became the largest bank in Nepal due to its impressive size and capital strength. The bank has a paid-up capital of Rs. 36.13 billion, making it a financial giant in the nation. It was established in 2007 as a commercial bank and achieved its current status through a strategic approach that involved the merger and acquisition of 21 banks and financial institutions. Global IME Bank incorporated five commercial banks, ten development banks, and six finance companies.

The bank is committed to growth, as demonstrated by its 'Vision-2025' strategic plan, which aims to double its business through the adept utilization of modern technologies and digitization. This forward-looking approach positions Global IME Bank not just as a financial institution but as a key player driving innovation and efficiency within the banking sector.

Global IME Bank has an extensive reach across Nepal and beyond. It has solidified its nationwide presence with a network of 355 branches, 377 ATM counters, 274 branchless units, and 65 extension counters, spanning all 77 districts of Nepal. This network ensures accessibility for customers from urban centers to remote regions, contributing to financial inclusion and economic development.

Global IME Bank has expanded internationally with representative offices in London (UK), New Delhi (India), and Sydney (Australia). These offices serve as gateways for global collaborations, fostering economic ties and contributing to the bank's standing in the international financial arena.

The bank's success is due to its dedicated workforce of over 4,000 employees. This team plays a crucial role in implementing the bank's strategic vision, providing excellent customer service, and driving innovation in banking services.

Global IME Bank has over 4.2 million customers, reflecting the trust and confidence it has earned from individuals and businesses. The bank is committed to customer satisfaction and excellence, making it a preferred choice for a diverse range of customers across the nation.

This achievement is not only a financial triumph but also a testament to the bank's impact on Nepal's economic landscape. Global IME Bank recently achieved the status of the highest taxpayer in Nepal. As the largest bank in the nation, Global IME Bank has demonstrated resilience, innovation, and a commitment to contributing significantly to the nation's economic growth. Global IME Bank shapes Nepal's banking sector through strategic plans, an extensive network, and international presence. The bank sets benchmarks for excellence and fiscal responsibility.

Its journey symbolizes not just financial success but a legacy of leadership, people-centric values, and a dedication to being a catalyst for positive change in Nepal's evolving economy.

Despite merging with several other banks, one of the biggest achievements of the bank is the acceptance of the leadership of Global IME.

The bank has undergone several mergers, yet no elections have taken place. Last year, Global IME and Bank of Kathmandu merged, and the board of directors was elected unopposed. Those who sit on our board work in the interest of the bank and shareholders first.

Under the leadership of Dhakal, Global IME Bank is now Nepal's largest bank and highest taxpayer, proving that the saying 'think locally and act globally' generates opportunities everywhere. Dhakal's positivism has been instrumental in the bank's success. It is important to keep personal matters separate when taking on a leadership role.

Under the leadership of Dhakal, Global IME Bank is now Nepal's largest bank and highest taxpayer, proving that the saying 'think locally and act globally' generates opportunities everywhere.

- IME GROUP: Expands Into Paper Industry

- Mar 24, 2025

- CPN UML: Instigated By India

- Mar 23, 2025

- ADB’S CHIEF ECONOMIST: Nepal Reduces Poverty

- Mar 11, 2025

- FM DR. DEUBA: A Successful Visit

- Mar 11, 2025

- MD GHISING: Target Of Personal Grudge

- Mar 09, 2025