An interaction program was convened in Kathmandu today to scrutinize the status of secured transactions in Nepal.

The event, jointly organized by Kathmandu University School of Law (KUSOL), the Secured Transaction Registry Office, and the International Financial Cooperation (IFC), aimed to explore and assess the efficacy of Nepal's secured transaction law introduced in 2006.

While Nepal took a significant stride towards modernizing its secured transaction law with the enactment of the Act in 2006, various weaknesses and gaps in its contents have come to light. With the Act formulated nearly two decades ago, it no longer aligns with contemporary best practices in several crucial aspects, thereby hindering its full potential.

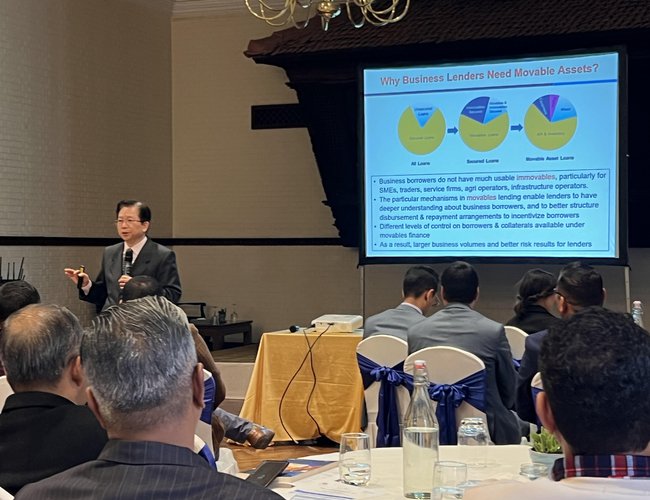

During the program, Mr. Babacar S. Faye, Resident Representative of the International Finance Corporation, and Prof. Rishikesh Wagle, Dean of KUSOL, emphasized the significance of secured transactions and lauded recent endeavors in this domain. Mr. Jinchang Lai, Principal Operations Officer of IFC, and Mr. Bruce Whittaker from the International Law Institute (via Zoom) elucidated the context of law and secured transactions, along with the current status and associated pros and cons in Nepal.

Associate Professor Shiva Kumar Giri, corporate lawyer Anup Uprety, Assistant Professor Santosh KC, and Advocate Suruchi Basnet deliberated on the challenges inherent in Nepal's Secured Transaction Act 2006.

Participants, comprising professors, banking executives, legal advisors, advocates, and practitioners, underscored the necessity of a flexible and modern framework allowing the use of movable property as collateral. This, they asserted, would expand credit availability and foster broader participation in economic activities.

Key recommendations emerged during the discussion, including the need to clarify key definitions, extend the Act's application to outright transfers of accounts, eliminate unnecessary provisions, incorporate obligations on parties to act in good faith and commercially reasonable manner, clarify the survival of security interests in insolvency, and introduce choice of law rules, among others.

Professor Bipin Adhikari, former law dean and participant in the forum, deemed the program highly significant. He emphasized to this correspondent the imperative of further discourse on the issue within the context of Nepal's significant informal economy, where transactions occur outside the formal legal framework and regulatory oversight.

In this informal sector, businesses and individuals often lack access to traditional banking services and formal credit markets. Instead, they rely on informal lending arrangements, personal networks, and so on to meet their financing needs.

According to Professor Adhikari, one of the challenges faced by secured transaction laws in such contexts is the need to recognize and enforce security interests in informal collateral that may include assets such as inventory, equipment, livestock, agricultural produce, or personal property that may not be easily identifiable, quantifiable, or readily transferable.

Secured transaction laws traditionally focus on formal collateral, such as real estate, vehicles, or financial assets, which can be easily registered, valued, and enforced through established legal mechanisms. However, in the informal economy, Adhikari opined, assets used as collateral may not meet these criteria. They may lack formal documentation, clear ownership titles, or standardized valuation methods, making it difficult to establish and enforce security interests in such assets.

The program's discussions shed light on critical areas for improvement in Nepal's secured transaction law, signaling a concerted effort toward enhancing the legal framework to foster economic growth and financial inclusion.

- The PROYEL Project Engages LGBTQ-Inclusive at the Local Level

- Dec 26, 2024

- Resumption Of Partial Power Production From Upper Tamakoshi Gives Some Relief To Power Supply System

- Dec 26, 2024

- Weather Forecast: Mostly Fair In Kathmandu Valley

- Dec 26, 2024

- Golchha Group Join Hands with ENSSURE for Industry-Led Apprenticeship Program

- Dec 25, 2024

- Ambassador Of Pakistan To Nepal Abrar H. Hashmi Met With PM Of Nepal KP Sharma Oli

- Dec 25, 2024