Nepali received Rs. 1,327.51 billion a record high remittance amountduring the first 11 months of the current fiscal year 2023/24.

According to NRB, remittance inflows increased by 19.3 per cent to Rs. 1,327.51 billion in the first 11 months of the current fiscal year.

Nepal received remittance of Rs. 128.91billion in a single month (from mid-May 2024 to mid-June 2024) of the current fiscal year.

In the US dollar terms, remittance inflows increased by 17.3 per cent to 9.98 billion in the review period compared to an increase of 13 per cent in the same period of the previous year.

In the review period, the number of Nepali workers, both institutional and individual, taking first time approval for foreign employment numbered 422,936 and taking approval for renew entry numbered 262,705.

In the previous year, such numbers were 459,415 and 260,262 respectively.The net transfer increased by 17.3 per cent to Rs. 1443.06 billion in the review period.

Similarly, the current account remained at a surplus of Rs. 200.39 billion in the review period against a deficit of Rs. 79.53 billion in the same period of the previous year.

In the US dollar terms, the current account registered a surplus of 1.51 billion in the review period against a deficit of 613.2 million in the same period last year. The balance of payments (BOP) remained at a surplus of Rs. 425.67 billion in the review period, up from Rs. 224.9 billion in the same period of the previous year.

In the US dollar terms, the BOP remained at a surplus of 3.2 billion in the review period against a surplus of 1.71 billion in the same period of the previous year.

A significant improvement has been noticed in foreign currency reserves, remittance inflows and balance of payment and current account during the first 11 months of the current fiscal year 2023/24.

According to the current macroeconomic and financial situation report based on 11 months of the current fiscal year published by the Nepal Rastra Bank (NRB) Wednesday, the foreign currency reserve of the first 11 months of the current fiscal year can cover the import of goods and services for one and a half years.

The foreign currency reserves reached an all-time high of Rs. 1,967.19 billion during the first 11 months of the current fiscal year 2023/24. According to NRB, the gross foreign exchange reserves increased by 27.8 per cent to Rs. 1,967.19 billion in mid-June 2024 from Rs. 1,539.36 billion in mid-July 2023.

The foreign currency reserves grew by about Rs. 24.79 billion during a single month (mid-May 2024 to mid-June 2024). The foreign currency reserves stood at Rs. 1,942.4 billion in mid-May 2024.

In the US dollar terms, the gross foreign exchange reserves increased by 25.7 per cent to 14.72 billion in mid-June 2024 from 11.71 billion in mid-July 2023.

The foreign currency reserves have been increasing from the beginning of the current fiscal year setting one record after another over the past few months.

The foreign currency reserve of the first 11 months of the current fiscal year can support the import of goods and services for one and a half years.

Of the total foreign exchange reserves, reserves held by NRB increased by 30.2 per cent to Rs. 1752.77 billion in mid-June 2024 from Rs. 1345.78 billion in mid-July 2023.

Reserves held by banks and financial institutions (except NRB) increased by 10.8 per cent to Rs. 214.42 billion in mid-June 2024 from Rs. 193.59 billion in mid-July 2023.

The share of Indian currency in total reserves stood at 22.3 per cent in mid-June 2024.

Based on the imports of eleven months of 2023/24, the foreign exchange reserves of the banking sector are sufficient to cover the prospective merchandise imports of 15.1 months, and merchandise and services imports of 12.6 months.

The ratio of reserves-to-GDP, reserves-to-imports and reserves-to-M2 stood at 34.5 per cent, 105.2 per cent and 29.2 per cent respectively in mid-June 2024. Such ratios were 28.8 per cent, 83 per cent and 25 per cent respectively in mid-July 2023.

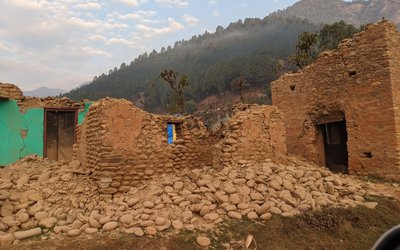

- National Earthquake Safety Day Today

- Jan 15, 2025

- Yoga Day celebrated In Various Parts Of The Country

- Jan 15, 2025

- Weather Forecast: Partly Cloudy In Hilly Some Regions of Gandaki, Bagmati and Koshi and Mainly Fair In The Rest

- Jan 15, 2025

- Foreign Minister Dr Rana Requested Qatar's Minister To Support To Release Bipin Joshi

- Jan 14, 2025

- Tharu Community Celebrates Maghi

- Jan 14, 2025