When Nepal Rastra Bank (NRB) unveiled the Monetary Policy for the fiscal year 2024/25, there was joy and expectation that the policy has brought so many changes to facilitate economic activities.

However, the first beneficiary of the monetary policy is the stock market. Historical data shows that the stock market generally has a bearish trend after monetary policy announcements, except for the record year.

Currently, the stock market is experiencing a notable pre-monetary policy rally, driven by bullish investor sentiment and positive technical indicators such as rising moving averages and increased trading volume. Investors are closely monitoring key support and resistance levels to assess the market's future direction. Based on past trends, a post-monetary policy correction seems plausible. However, if the market is to surpass previous records, the current bullish momentum, supported by robust fundamentals and positive technical indicators, could continue throughout the fiscal year and potentially set new benchmarks.

Over the past five years, the NEPSE index has shown limited growth following monetary policy announcements, with the exception of one fiscal year. From fiscal 2076/77 to 2080/81, the stock market generally experienced a bearish trend after four consecutive fiscal years of monetary policy implementation, with only one fiscal year showing a significant bullish trend.

On July 24, 2019, Governor Chiranjibi Nepal announced the monetary policy for the fiscal year 2076/77. This announcement initially resulted in a modest uptick of 6.90 points in the NEPSE index, which rose to 1284.07 points. However, this was followed by a prolonged downtrend characterized by consecutive lower lows and lower highs. It took 176 days for the NEPSE to return to the 1284.07 level. During this period, the index experienced a significant decline of 182.53 points to a low of 1102.46 points.

This policy significantly increased market liquidity and fueled excessive credit flows into the stock market. While the expansionary monetary policy spurred credit growth, its broader economic benefits were limited and led to significant deleveraging.

Although the country's central bank has cut the bank rate and the deposit overnight rate, what the policy has changed in the stock market, where the market has been bullish since last month, setting the new record.

A positive circuit breaker has been imposed in Nepal Stock Exchange (NEPSE) index almost every day since the announcement of the new monetary policy.

NEPSE informed that trading was closed for 20 minutes on August 7 as NEPSE index increased by four percent in one minute and 31 seconds after the start of today's trading.

The positive effect of the monetary policy of the current fiscal year 2081/82 has been seen in the capital market.

After almost three years of decline, the new monetary policy has given new life to the stock market. With the announcement of the policy,

Monetary Policy Eases Managing Capital Fund Stress

The monetary policy has introduced some flexible provisions for managing the pressure on the capital funds of banks and financial institutions. For this purpose, the NRB has adopted the policy of encouraging the use of capital fund instruments and new instruments.

The provision of the existing 1.20 percent credit loss to be made on good loans has been reduced and maintained at 1.10 percent. Similarly, the NRB stated that the provision related to the risk weighting applied to the purchase and sale of loans will be reviewed.

It is stated that the existing limit of Regulatory Retail Portfolio (RRP) has been increased from Rs. 20 million to a maximum of Rs. 25 million.

A provision has been made whereby the banks and financial institutions, while calculating the 'Tier 2 Capital', may calculate the appropriate 'reserve amount' in the regulatory reserve as Tier 2 Capital, remaining under the provision of the Capital Adequacy Framework-2015, in such a manner that the total capital fund is not double the primary capital fund.

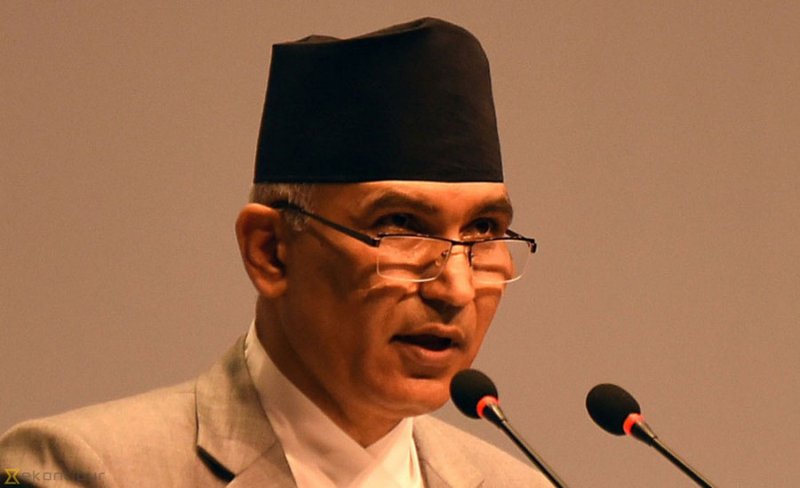

"The ceiling of the bank rate in the interest rate corridor has been maintained at 6.5 percent from 7 percent and the policy rate has been fixed at 5 percent from 5.5 percent," NRB Governor Maha Prasad Adhikari said while unveiling the policy.

However, the deposit rate, which remains the floor of the interest rate corridor, has been kept unchanged at 3 percent. The provision of permanent liquidity facility in the bank rate has been continued and the conditions for providing liquidity will be made flexible, the NRB said.

Similarly, the existing provision relating to compulsory cash ratio and authorized liquidity ratio to be maintained by banks and financial institutions has been continued.

Announcing the monetary policy for the fiscal year 2024/25, Governor Adhikari said that the monetary policy has been cautiously geared towards flexibility to make the economy vibrant keeping in view the ease of prices and the status of the external sector.

Similarly, the policy has emphasized on improving the flow and quality of credit to the productive sector. A regulatory system has been formulated to maintain fiscal stability.

How Dynamic Monetary Policy

Nepal Rastra Bank has announced the monetary policy for the current fiscal year with an aim to make the country's economy more dynamic. In the monetary policy announced by Governor Adhikari, the direction of prudent and flexible monetary policy has been continued to make the economy dynamic.

"Based on the analysis of the situation, keeping in view the comfortable price and external sector situation, the direction of prudent and flexible monetary policy has been continued to make the economy dynamic," it says in the monetary policy.

The monetary policy has made regulatory arrangements to maintain financial stability while emphasizing on lending to the productive sector and improving the quality of credit.

The Governor official informed that the monetary policy and regulatory policy have been aligned to facilitate credit disbursement without adversely affecting the overall economic stability.

The objective of the monetary policy is to manage liquidity and direct the flow of credit to the productive sector in order to help achieve the economic growth rate of 6 percent as estimated by the government in the budget for the current fiscal year.

Similarly, the growth rate of broad money is projected at 12 percent and the growth rate of credit to the private sector at 12.5 percent.

Nepal Rastra Bank (NRB) has unveiled a monetary policy for the current fiscal year with the aim of encouraging microfinance institutions to merge.

The monetary policy has given priority to protecting the interests of clients and addressing complaints regarding the services provided by these institutions. NRB Governor Adhikari said that necessary regulatory arrangements would be made to protect the interests of customers based on international best practices.

The monetary policy has made arrangements for timely review of regulatory arrangements related to interest rates on loans and service charges taken by microfinance institutions, as well as rescheduling of loan by paying a certain percentage of interest for customers who are unable to pay their loans to the microfinance institutions due to situation.

Further arrangements would be made to encourage those microfinance institutions to work by limiting their scope of work in a certain province and place according to the monetary policy. (RSS)

The bank rate of the upper limit of the interest rate corridor has been maintained from 7 percent to 6.5 percent and the policy rate from 5.5 percent to 5 percent.

Relief for developers

The monetary policy has given various concessions to the builders including extension of the interest payment period till mid-December 2081 and not blacklisting them only on the basis of bounced cheques.

Ease of capital

To ease the capital management of banks and financial institutions through monetary policy, the existing loan loss provision of 1.20 percent for good loans has been reduced to 1.10 percent. Similarly, the regulatory limit for retail portfolio (RRP) has been increased from Rs. 20 million to Rs. 25 million.

Revisions to current lending guidelines

It is mentioned in the monetary policy that the current capital loan guidelines will be amended to extend the period for adjusting the loan through 'variance analysis' and will be applicable from July 1, 2082 and to review the limit of Rs. 1 crore for micro, domestic, small and medium enterprises.

Limit on institutional share mortgage loans removed

For institutional investors, the existing limit of Rs. 200 crore for the loan provided by banks and financial institutions in the form of margin securities has been removed. The personal limit of Rs 15 crore has been retained.

Classification of Loans

The system of classification of NPAs into good category only after six months has been modified and classification of NPAs into micro-monitored category for six months has been introduced and the system of classification of NPAs into good category only after that period has been introduced.

Unsecured loans

The monetary policy has also included the provision of unsecured loans for foreign employment in the budget of the current fiscal year.

Similarly, the National Bank has also adopted a policy to facilitate loans to the agricultural and innovation sectors.

Legislation

Issues such as the drafting of the Asset Management Law and its submission to the government and the preparation of guidelines on artificial intelligence (AI) are included in the monetary policy.

Management of the cooperative and microfinance sector

In order to solve the problems of savings and credit cooperatives, the monetary policy states that the National Bank will support the implementation of the system of refunding the amount up to Rs. 1,000.

Rastra Bank has also stated that it will coordinate with the Government of Nepal to formulate the necessary laws for the establishment of a separate mechanism for the regulation and supervision of savings and credit cooperatives. Similarly, arrangements have been made to merge microfinance institutions, reschedule loans and revise service charges, and pay more attention to customer grievance redressal.

Import relaxation

The existing limit of facility available for import of goods through draft and TT has been increased from USD 35,000 to USD 50,000. Similarly, the existing limit for import under Document Against Payment and Document Against Acceptance has been increased from USD 60,000 to USD 100,000. With these regulations, it is expected that the import of goods will increase somewhat.

Payment limit from dollar account will be increased

It is mentioned in the monetary policy that the limit that can be spent from convertible foreign currency accounts opened in Nepal will be increased. Similarly, the National Bank has also taken a policy to facilitate the existing arrangements related to foreign exchange facilities available through passports. It is said that the existing list of foreign currencies that can be exchanged to facilitate activities such as remittance flow, visit, trade etc. will be reviewed.

Payment System Reform

It is mentioned in the monetary policy that the infrastructure and institutional structure necessary to fully operationalize the National Payment Switch. Similarly, organizations dealing with payment, clearing and settlement will be transformed into public limited companies.

Emphasis on credit expansion

For the current fiscal year 2081/82, it is mentioned in the monetary policy that the liquidity management and credit disbursement will be directed to the productive sector in order to help achieve the economic growth of six percent.

For the current fiscal year, the growth rate of detailed money supply will be 12 percent and the growth rate of credit to the private sector will be 12.5 percent, the National Bank has predicted.

No blacklisting for bounced checks

The National Bank has adopted a policy of revising the existing credit information and blacklisting instructions to amend the rules of blacklisting based on bounced checks and restriction of banking transactions.

Similarly, if the institution invested by private equity and venture capital is unable to repay the loan for any reason and is blacklisted, it is mentioned in the monetary policy that the private equity and venture capital that invests will not be blacklisted.

Bonds will be counted as sector loans

The monetary policy of the current fiscal year has provided that energy-related bonds can be counted as sectoral loans. In order to increase investment in the energy sector, the monetary policy mentions that investment in energy-related bonds, including energy bonds issued by the specialized organizations related to the energy sector, should be invested in the energy sector and can be calculated within the specified limits.

The sentiment of the monetary policy seems to be focused on increasing demand: FNCCI President Chandra Prasad Dhakal

Chandra Prasad Dhakal, President of Federation of Nepal Chamber of Commerce and Industry, responded that the monetary policy has tried to address the current market problem..

He said that although most of the arrangements will be made through guidelines, the policy spirit will be flexible and demand will increase.

He said that the 12.5 percent credit expansion, reduction of provisioning for good loans, efforts to address problems in the construction sector and facilities provided to the manufacturing industry are good.

Though the monetary policy has already come out with over enthusiasm on the stock market, it remains to be seen how the policy will help in accelerating the economic activities in the country.

Despite the appreciation from the business communities, economists and members of parliament raised the questions on promoting the stock market and supporting it through various concessional provisions.

- GLOBAL IME BANK: Celebrating Eighteen Years of Progress

- Jan 13, 2025

- JALPADEVI CABLE CAR: IME Group's Latest Project

- Jan 12, 2025

- NIMB Achieves Accreditation With Green Climate Fund (GCF)

- Jan 10, 2025

- NATIONAL UNITY DAY: Unity Trail

- Jan 10, 2025

- TOURISTS ARRIVAL: Surpass A Million

- Jan 10, 2025