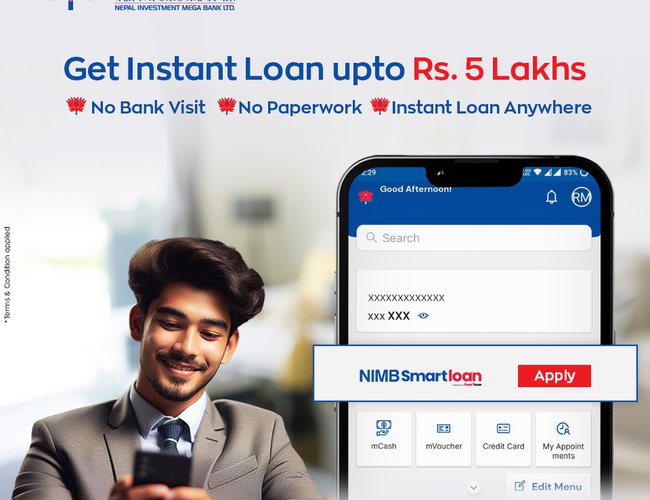

In an initiative towards financial inclusion and accessibility, Nepal Investment Mega Bank Limited (NIMB) has announced the upgraded version of ‘NIMB Smartloan’ a new mobile loan feature available within the NIMB Smart mobile banking app. With this feature, an eligible customer has access to an instant loan up to Rs. 5,00,000 directly through NIMB Smart app without the need of any collaterals, paperwork or bank visits.

Eligible account holders can enjoy a loan based on their individual loan limit set by the bank. NIMB offers flexible repayment options allowing customers to choose from a repayment period of 1 month or in installments (EMI) spread up to 36 months. Additionally, this service also has an option of prepayment facility.

Customers can easily register for NIMB Smartloan through the NIMB Smart app by providing a verified email address. Eligibility for NIMB Smartloan is decided by various criteria set by the bank such as having a salary account, regular transactions, no pending loan with the bank, loan repayment behavior. Eligible customers will be able to apply NIMB Smartloan from the dashboard of NIMB Smart app and can avail the service.

Bishwa Singh, Head of Digital Payments at NIMB, shares his enthusiasm for the launch, "We are keen to introduce the upgraded version of NIMB Smartloan. With the highest loan amount offered through any mobile platform in the industry, we aim to empower our customers by providing a more convenient and accessible financial solution that meets their needs."

- Nepal Electricity Authority cancels contract worth over Rs 1 billion, now electricity wires going to customers' homes are bare

- Apr 21, 2025

- Four people died in Taplejung after their vehicle caught fire after getting entangled in a live wire

- Apr 21, 2025

- RPP General Secretary Rana released on bail

- Apr 21, 2025

- Nepal requires Rs 21.165 trillion to implement SDGs goals

- Apr 21, 2025

- Putin's unilateral 'Easter ceasefire' ends, Ukraine suggests partial truce

- Apr 21, 2025