Business services are essential for promoting entrepreneurship in rural areas and equipping young people with the knowledge and skills needed to run successful businesses. Creating jobs for youth is a priority for a responsible government. Young people entering the labor market as potential entrepreneurs face many challenges. These include limited access to business knowledge and skills, technical skills and business education. The lack of business services in rural Nepal hampers opportunities for business networking, individual-level entrepreneurship development, and mentorship to refine their business ideas.

How do business services help overcome the challenges of starting a business?

Business mentorship programs that connect potential entrepreneurs with experienced service providers and business owners are critical to overcoming initial challenges such as developing business plans, managing finances, and understanding market dynamics. Through such support, young entrepreneurs gain valuable insights and avoid common pitfalls. Business incubators and learning centers at the local level, which provide shared office space, Internet access, administrative assistance and sometimes financial support, offer essential business guidance to young entrepreneurs. In addition, technical skills in digital marketing, customer relationship management, and financial management increase the competitiveness of rural businesses. These resources empower young people to start and sustain businesses that stimulate local economies, create jobs, and improve rural livelihoods.

Business services for entrepreneurship development include a variety of support activities that facilitate the management of new and existing businesses and viable value chains based on market opportunities. These services include business planning, financial literacy and management, market analysis, relationship marketing, access to affordable finance, and technical advice on legal and regulatory issues. Public and private institutions, non-governmental organizations, and development programs often provide these services. For example, business planning assistance helps entrepreneurs assess the feasibility of their ideas, understand market needs, and plan for growth. Financial literacy training teaches entrepreneurs how to manage resources effectively, helping them to budget, save, invest and make sound financial decisions. Market analysis services provide insights into customer preferences, industry trends and competitor activities, enabling entrepreneurs to refine their offerings and identify new opportunities.

How financial literacy supports business development

Financial literacy is critical for potential entrepreneurs, providing them with the skills to make informed financial decisions, manage resources efficiently, and plan for long-term sustainability. Many entrepreneurs, especially those from producer groups, lack basic financial literacy, which can hinder effective cash flow management, budgeting, and financing. Without financial literacy, they risk financial instability, such as taking on excessive debt or failing to track expenses, leading to potential business failure. Financial literacy training provides essential skills in budgeting, saving, borrowing and investing that are essential for effective business management. It also enables entrepreneurs to assess and manage risk in volatile markets. Financial literacy enables entrepreneurs to negotiate effectively with financial institutions and to understand loan terms, interest rates and repayment obligations. In this way, financial literacy provides a foundation for building stable, profitable businesses and enables entrepreneurs to scale their businesses with confidence.

In Nepal, financial institutions play a critical role by providing access to credit, offering financial advice, and creating business-relevant credit products. For example, microfinance institutions provide small loans to rural entrepreneurs-primarily producer groups-who may not qualify for traditional bank loans due to a lack of collateral or credit history. By offering smaller, more manageable loans, microfinance institutions encourage the growth of microenterprises in rural communities. By partnering with entrepreneurship development organizations, financial institutions expand their reach, particularly in remote areas, thereby increasing access to financial services and promoting economic growth.

However, access to finance remains a significant challenge for many Nepalese entrepreneurs, especially those in rural, marginalized communities. A major problem is the lack of collateral for smallholder farmers and producer groups, who often lack assets to secure loans. High interest rates also discourage entrepreneurs, especially those from low-income backgrounds, who fear the financial burden of repayment. In addition, complex and bureaucratic loan application processes can deter small business owners. Limited awareness of available financial products further limits the ability of entrepreneurs to secure financing for business needs. Financial institutions often view lending to start-ups as risky, creating a gap in business financing. Geographic and digital access barriers also limit rural entrepreneurs' ability to access financial services, particularly in remote and hilly areas. Addressing these challenges requires a multifaceted approach, including policy interventions, financial literacy initiatives, and the development of inclusive financial products tailored to the diverse needs of entrepreneurs across regions and sectors. Such efforts can help Nepal build a more inclusive financial landscape that supports entrepreneurship nationwide.

Successful model of localization of business services

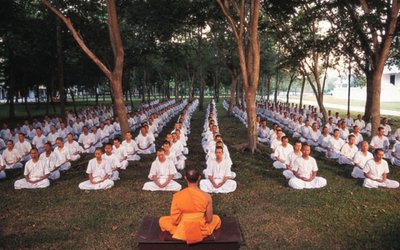

Helvetas Nepal's InElam project, for example, uses the Enterprise Service Providers (ESPs) model to establish a sustainable, market-driven support system for rural entrepreneurs, with the aim of localizing business services. Working in the Karnali and Madhesh provinces of Nepal, the InElam project works with local Enterprise Service Providers (ESPs) to provide services such as business training, mentoring, facilitating access to finance, and facilitating market linkages. This model fosters a supportive business ecosystem that enables local entrepreneurs to start and sustainably grow their businesses. A key feature of this model is its cost-sharing basis, where entrepreneurs and local governments contribute a portion of the service fees, enhancing its financial sustainability and scalability through partnerships with market actors. The model builds the capacity of local entrepreneurs and improves access to business services. It also focuses on strengthening local business ecosystems by improving skills, fostering innovation, and promoting inclusive entrepreneurship, thereby creating jobs for disadvantaged communities. Through the InElam project, Helvetas Nepal is demonstrating the power of sustainable value chain development at the local level in different value chains to promote sustainable enterprises.

Conclusion

Business services and financial literacy are essential to support entrepreneurship, especially in rural areas where young people face unique challenges in starting and growing businesses. Financial institutions in Nepal play a critical role in this process by providing business-friendly financial products, financial advisory services, and working with Enterprise Service Providers (ESPs) to reach the maximum number of potential entrepreneurs at the local level. However, challenges such as lack of collateral, high interest rates and limited access to financial products remain, highlighting the need for policy support and inclusive financial services. Helvetas Nepal's InElam project demonstrates a sustainable model for entrepreneurship development by creating a supportive ecosystem for local entrepreneurs through local level ESPs.

Sandip Poudel has extensive professional experience in entrepreneurship development, private sector promotion, market system development for employment generation and enterprise development in both private sector and development organizations for over 15 years in Nepal and other countries. This is his personal perspective. He can be contacted at poudel_sandip@yahoo.com